Israel prepares to call up 450,000 soldiers amid mounting toll on reservists and their families

The escalation of Israel’s operations in Gaza has renewed turmoil in reservists’ lives — and resentment about haredi Orthodox Jews who avoid military service.

Advertisement

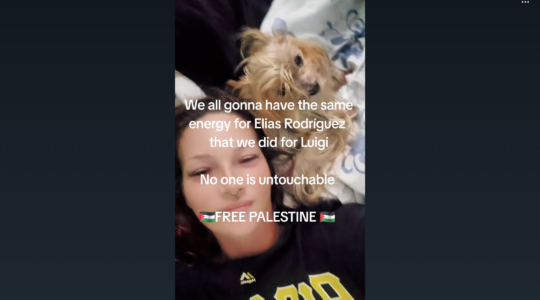

CAPITAL JEWISH MUSEUM SHOOTING

More News

ISRAEL

Advertisement